Key Takeaways

-

Underestimating Electricity Capacity: The UK government needs to prepare for a 250% increase in electric capacity by 2050. While sources vary regarding the UK’s exact expectations for future electricity demand, they all suggest the government is underestimating.

-

Unnecessarily Ambitious Interim Wind and Solar Targets: Interim targets of 50 GW of offshore wind by 2030 and 70 GW of solar capacity by 2035 are more than what’s necessary to stay on track for net-zero by 2050. By 2030, the UK needs closer to 23 GW offshore, 36 GW onshore, and 51 GW solar. By 2050, the UK needs 80 GW offshore, 36 GW onshore, and 57 GW solar.

-

Expanding the Nuclear Fleet: By 2050, the UK will need around 61 GW of nuclear energy under the most cost-effective pathway to net-zero, more double the current government target of 24 GW. Failure to reach this level of deployment will require building significantly more offshore wind and increase transition costs; however, a breakthrough in nuclear costs could unlock additional opportunities for nuclear applications. As evident by the Civil Nuclear Roadmap released in January 2024, the UK is already preparing to re-awaken its nuclear industry.

-

Ramping Up Investment: To build a net-zero power system, the UK will need to invest over £550 billion of public and private investments through 2050. This does not include major upgrades required to the grid, carbon capture and sequestration infrastructure, and hydrogen production. Smart public policy can unleash private sector investments to realize this transition – allowing the UK to reduce its exposure to expensive and volatile fossil fuel prices, increase its energy independence, and become a leader in growing global clean energy markets.

-

Enormous Offshore Wind Potential: The UK has access to vast offshore wind potential, capable of generating over 1000 GW if fully harnessed, 40% of which is below 109 euros (£95) per megawatt hour. This is the second highest offshore wind potential in Europe, just behind Norway at around 1100 GW.

-

Opportunity to Lead on Clean Hydrogen: Thanks to abundant offshore wind resources and ability to grow its nuclear industry, the UK could be the #1 producer of clean hydrogen in all of Europe.

-

Picking Electrification Over Hydrogen: Despite being a leader in clean hydrogen, it still makes sense for the UK to pick electrification over hydrogen wherever possible for heating, transportation, and industrial processes.

-

Building Consumer Confidence: Policymakers must implement solutions that increase consumer access and confidence in electric options. If consumers are slow to adopt new clean technologies and electrify their industries, businesses, and households, then reaching net-zero will require more carbon capture, utilisation, and storage (CCUS), direct air capture (DAC), and imported zero-carbon fuels.

Introduction

The United Kingdom established its legal commitment to achieving net-zero emissions by 2050 in 2019.1 Despite this ambitious stance, recent setbacks, such as the UK government's postponement of the ban on new diesel and petrol cars from 2030 to 20352 and the lack of bids in a recent offshore wind auction,4 prompt reflection on the nation's path to fulfilling both short-term and long-term environmental goals. In response, the UK has adjusted price caps for offshore wind and renewable sources, underscoring the crucial need for investor security.5 Navigating delays and unforeseen events raises the question of how the UK can reconcile its legally binding obligation to achieve net-zero emissions by 2050 with challenges to achieving interim commitments like the 2030 nationally determined contribution (NDC).6

The UK’s energy landscape is still heavily reliant on fossil fuels, constituting 75% of the energy supply and powering 44% of its electricity.7 In the wake of geopolitical challenges, exemplified by Russia's invasion of Ukraine, the UK is committed to not only reducing its dependency on fossil fuels, but also diversifying its fossil fuel trade partners. Former Prime Minister Liz Truss's acknowledgment of the UK's overreliance on authoritarian regimes for economic necessities underscores the urgency for a comprehensive shift toward clean energy.8 Reducing dependence necessitates a holistic economic transformation towards clean energy.

Impediments to transformation including de facto bans on onshore wind (despite being theoretically lifted), insufficient incentives for investors, and bureaucratic obstacles that currently hinder innovation and damage consumer confidence. This is despite motivators like legal commitments, international agreements, energy security imperatives, and leadership in energy transition technology and policy. In this memo, we use our energy systems modelling analysis to confront these impediments head-on and outline critical choices and their consequences to achieving emission abatement goals.

We start with an overview of how the UK can achieve net-zero, based on the ‘Core Pathway’ of our energy system analysis, and how that compares to the UK’s current goals. We then highlight how the UK can become a global leader in offshore wind and clean hydrogen. The final section explores three alternative net-zero scenarios, which demonstrate the importance of electrification, critical role of consumer confidence and adoption of clean technologies, and the opportunity of emerging nuclear energy technologies with lower costs and new applications.

Energy Systems Modelling

This memo is part of a broader study from Carbon-Free Europe (CFE) that modelled 12 potential pathways (5 scenarios and 7 sensitivities) for the EU and UK to achieve net-zero emissions by 2050. Each pathway considers different choices relevant for the energy systems and predicts what needs to be done to reach net-zero based on the decisions taken. This analysis provides a roadmap for how the UK can reach net-zero targets. It shows what technologies need to be deployed, how quickly, and where. It shows how sectors can work together to maximise efficiency, how technological breakthroughs create new possibilities, and how we can maintain grid reliability even with a high penetration of renewables.

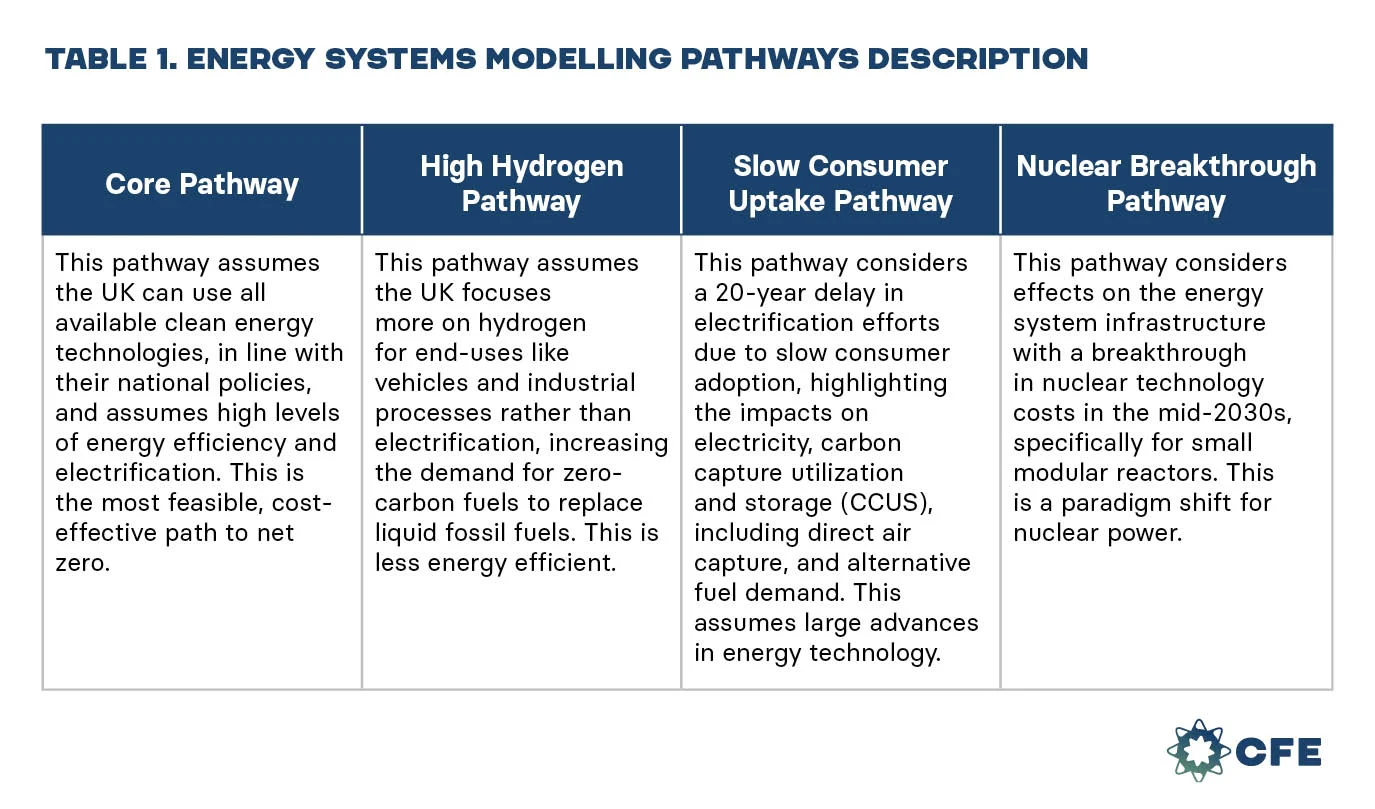

This memo considers four pathways which are described below. The ‘Core Pathway’ is the lowest cost scenario with the least barriers to reaching net-zero. To learn more about the other pathways and our full 2023 analysis, please click here.

How the UK Can Achieve Net-Zero

This section compares the UK’s current clean energy goals with our analysis of what it will take to reach net-zero. Here, we focus on results from our ‘Core Pathway,’ which is the most feasible, cost-effective path to net-zero. On the one hand, the UK is underestimating what is required – for example predicted increases in electricity capacity. On the other hand, the UK is setting unnecessarily ambitious timeframes for clean energy deployment – for example with offshore wind.

Core Pathway: This pathway assumes the UK can use all available clean energy technologies, in line with their national policies, and assumes high levels of energy efficiency and electrification. This is the most feasible, cost-effective path to net-zero.

Clean Energy Deployment Targets

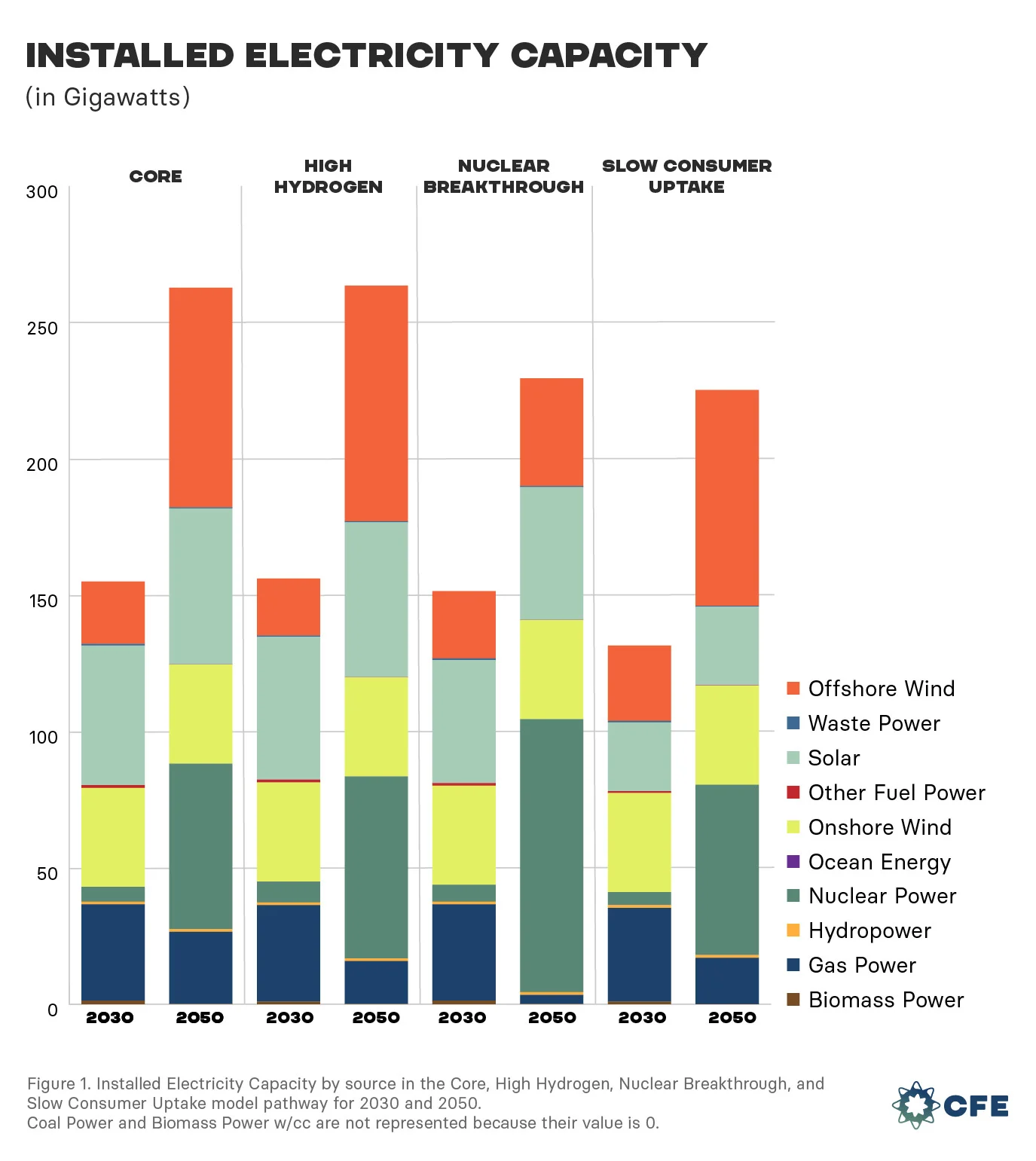

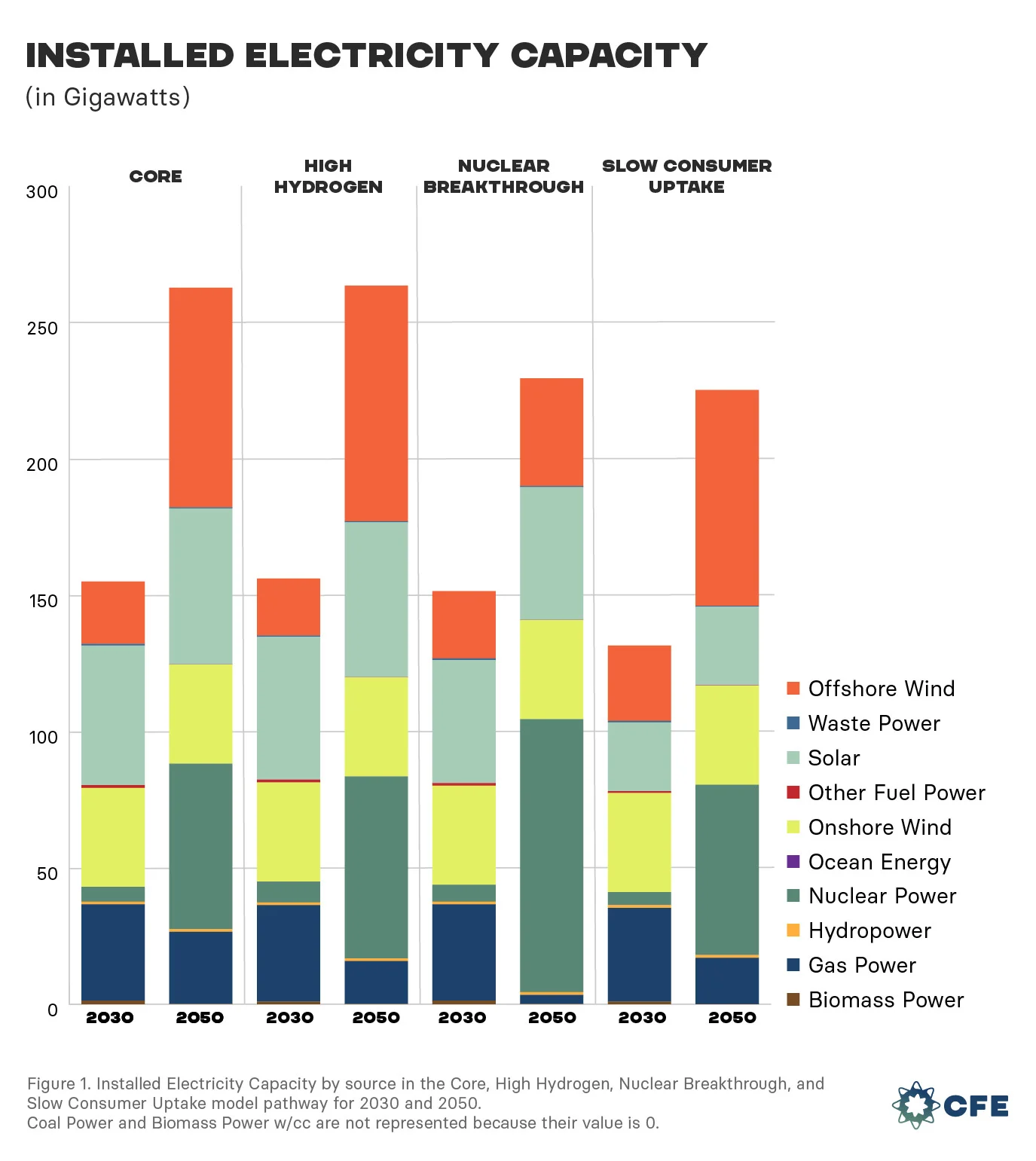

Right now, the UK has goals to deploy 50 GW of offshore wind by 2030, 70 GW of solar capacity by 2035, and 24 GW of nuclear by 2050. Additionally, clean power by 2035 and even 2030 are actively discussed. While the ambition is commendable, fully clean power by 2035 is not the most cost-effective and the offshore wind target is way ahead of schedule for what is needed. According to our analysis, the UK needs to deploy 1 GW of offshore wind every year through 2030 for a total capacity of 23 GWs by 2030 (Figure 1). There is more breathing room in these earlier years, which is great news considering that no bidding was performed at recent offshore wind auctions to prepare future deployment. By 2050, the UK will need around 80 GWs of offshore wind capacity, most of which can be prepared for and spread out from 2030 to 2050.

The UK’s goals are again overestimating when it comes to solar. Instead of 70 GW by 2035, our analysis suggests the UK will need closer to 52 GW. With current solar capacity at 15.2 GW, the UK would need to deploy around 3 GW of commercially viable sites per year to reach 52 GW by 2035 (5 GW per year to meet 70 GW). Since 2017, the UK has deployed an additional 2 GW of solar power of which 1 GW was deployed between June 2022 and June 2023.9 Considering historic deployment rates, the UK should ensure ambitious, yet realistic deployment goals so supply chains, permitting, and the workforce can keep pace.

In contrast to the UK’s wind and solar goals, the nuclear energy target of 24 GW by 2050 is underestimating the necessary deployment. Our analysis suggests the UK will need around 61 GW of nuclear energy by 2050. That is equivalent to 20 power plants of the currently under construction Hinkley Point C (3.2 GWe).10 Today, the UK has around 6.5 GW of nuclear.11 The government’s new Civil Nuclear Roadmap is an excellent start to recapturing the UK’s global nuclear energy leadership, which will be necessary if the UK plans on achieving emissions reduction goal. If the nuclear energy industry cannot be scaled to meet this demand, then the UK will need to compensate for the energy gap with disproportionally more offshore wind capacity due to a lower capacity factor, which in turn may be more expensive and less energy efficient.

The UK is well positioned to leverage its nuclear and offshore wind industry to provide energy to mainland Europe. UK was a net importer between 1978 and 2021, and net exported 4 TWh (1 TWh = 1 billion kWh) in 2022.12 We estimate that the UK could net export 55 TWh of electricity by 2050, establishing itself as a keystone player in accomplishing all of Europe’s climate and energy security goals.

To recap, according to the ‘Core Pathway’ of our analysis, the UK must maintain the current clean power capacity and additionally deploy at least:

-

By 2030: 22 GW onshore wind, 11 GW offshore wind, and 35 GW solar. That means, the UK needs to construct 5,500 onshore 4 MW wind turbines, 917 offshore 12 MW turbines, and 485 photovoltaic farms like the largest PV of the UK with 72 MW.13

-

Additionally, by 2050: 57 GW offshore wind, 6 GW solar, and 56 GW nuclear. Again, the UK needs to construct 4,750 offshore 12 MW turbines, 83 PV farms at 72 MW each, and 56 nuclear power plants with 1000 MWe capacity.

All this deployment is recommended on top of maintaining the current clean energy capacity and grid, or, where needed, replacing old infrastructure equally.

Investments Needed to Transform the Grid

Executing this scale of clean power deployment entails significant investment. Our analysis estimates cost until 2050 of at least:

-

£552 billion total: £230 billion for offshore wind, £40 billion for onshore wind, £37 billion for solar power (PV), and £245 billion for nuclear. This includes only the power sector. It does not include maintenance and major upgrades required to the grid, carbon capture utilisation and storage (CCUS) implementation, and hydrogen production (£25 billion), or other sector transitions.

-

Financial preparation is crucial: Financially intensive periods commencing in 2030, require annual investments from the private and public sector exceeding £35 billion—equivalent to 1.3% of the 2021 gross domestic product.

While this is no small investment, smart public policy can unleash the private sector to realize this transition. And the benefits far outweigh the costs. In addition to the emissions reduction benefits, this investment will reduce the UK’s exposure to expensive and volatile fossil fuel prices, increase its energy independence, and enable it to become a leader in growing global clean energy markets.

Future Increases in Electricity Demand

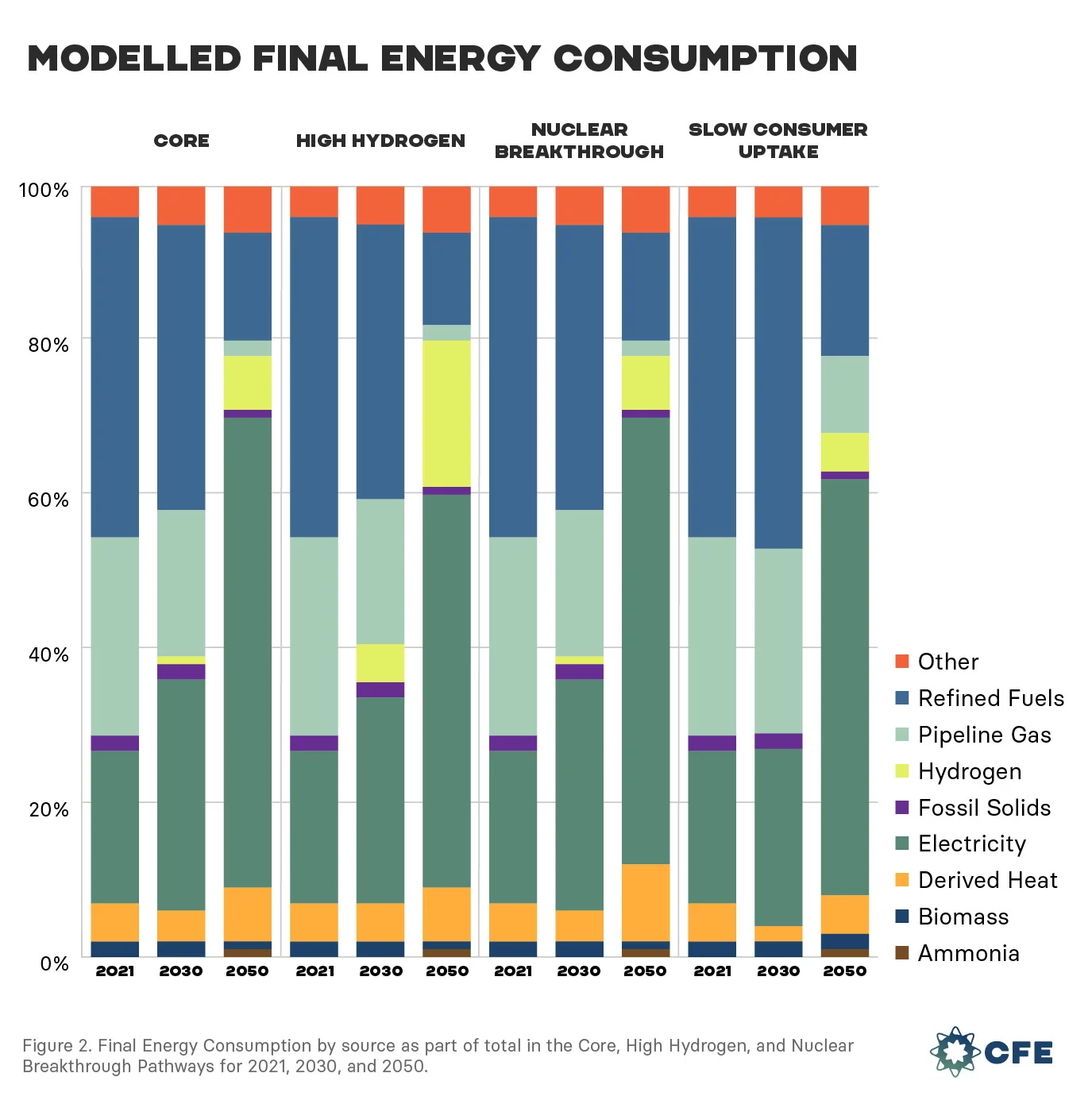

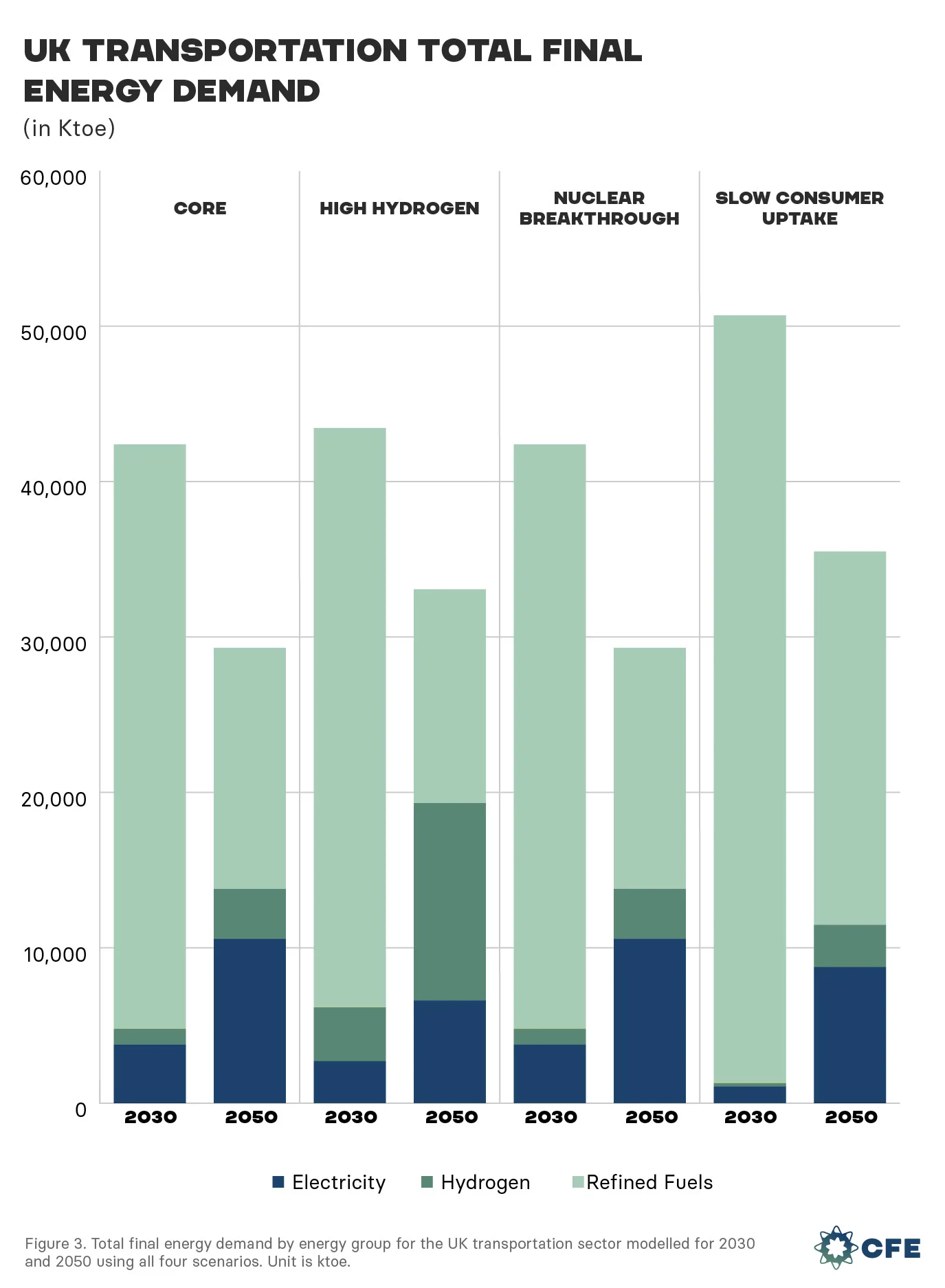

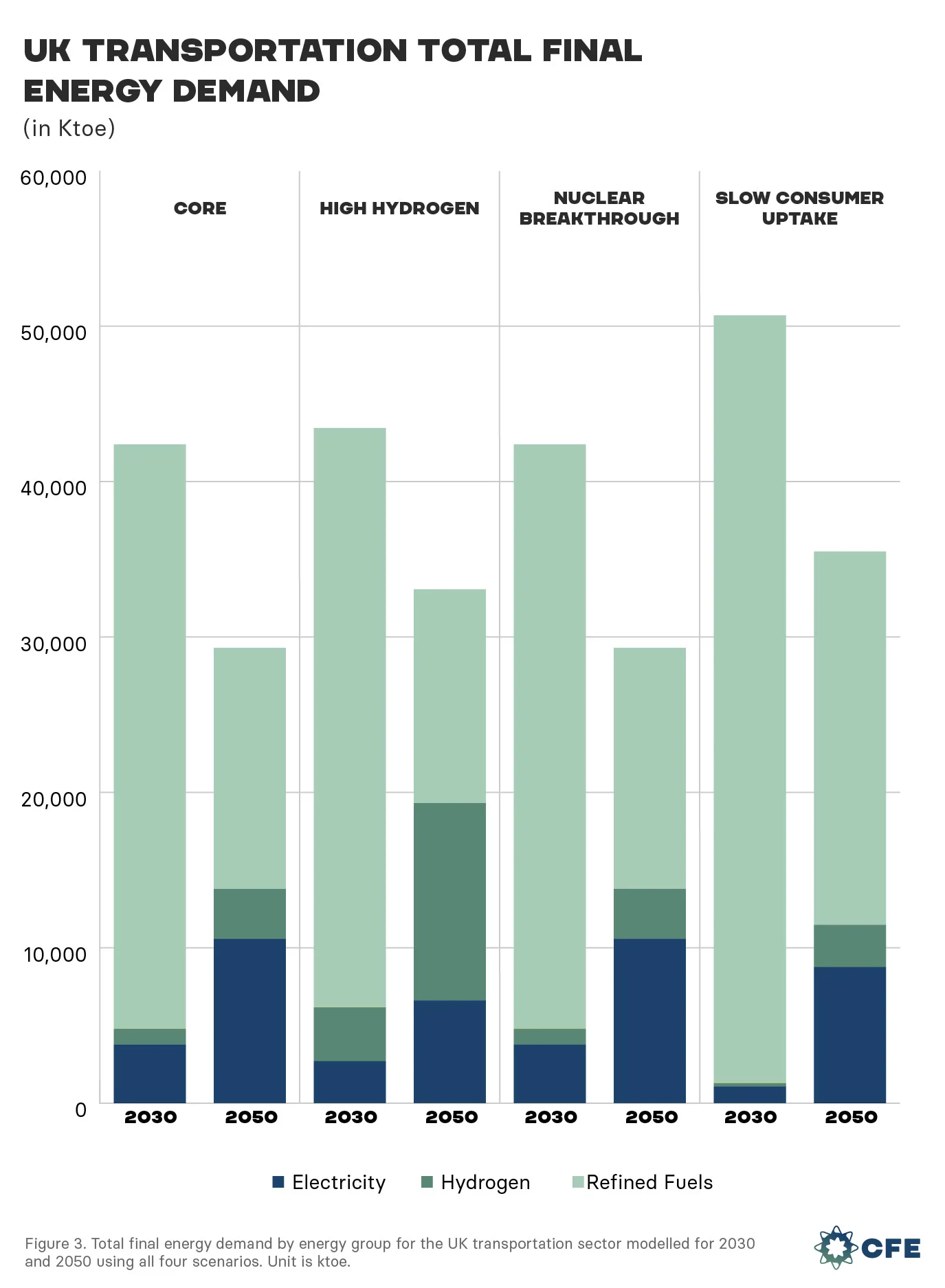

While the UK is ahead of the curve on interim clean energy deployment targets, it is likely underestimating the growth in electricity demand as it electrifies huge portions of its economy. We project, based on our “Core Pathway”, that electricity should increase from 20% to 30% of total final energy consumption by 2030 and reach 61% by 2050 (Figure 2). The electrification of transportation plays a large role in this. By 2050, 57% of the transport sector (aviation excluded, ~10mtoe) is electrified, including over 90% of the passenger vehicle fleet (Figure 3).

As a result, by 2030 we project electric capacity to be 155 GWs, increasing to 262 GWs by 2050 – 250% of current capacity.14 This is despite efficiency improvements that will reduce overall energy consumption by 23% by 2050.

There are communication inconsistencies between advisory bodies and the UK government that create uncertainty around the government’s expectations for future electricity demand. The UK government claims that increasing nuclear generation to 24 GW by 2050 will cover 25% of the country’s electricity demand,15 which suggests, if nuclear power is solely used for power and has a capacity factor of 95%, demand will be somewhere in the ballpark of 770–800 TWh. Alternatively, the Climate Change Committee and National Grid state that electricity generation needs to at least double by 2050.16 Given today’s roughly 300 TWh of electricity demand, this suggests the UK is preparing for around 600 TWh. Finally, a December 2020 electricity system analysis from the Department for Business, Energy & Industrial Strategy estimates 575-672 TWh by 2050.18 Regardless of which source we look at, all sources suggest the UK is underestimating future electricity demand. Our model suggests the UK is an electricity net exporter to Europe (55 TWh) and needs around 900 TWh of electricity generation by 2050. The government therefore should review its models and projections, and clearly communicate the UK’s expectations for future electricity capacity and generation.

Becoming a Global Leader in Offshore Wind and Clean Hydrogen

Meeting the UK’s net-zero targets is challenging, but the UK also has huge natural opportunities that can be unlocked. This section highlights the importance of offshore wind in the UK's energy future. The UK possesses vast offshore wind potential, capable of generating over 1000 GW of renewable power if fully harnessed. While the ambitious target of achieving 50 GW of offshore wind by 2030 is ahead of schedule and faces feasibility challenges, the UK is right to pursue offshore wind as a cornerstone of its decarbonisation efforts. Its greatest chance of success will be maximising this impressive offshore wind potential while balancing its energy portfolio with onshore wind, solar, storage, nuclear, and hydrogen.

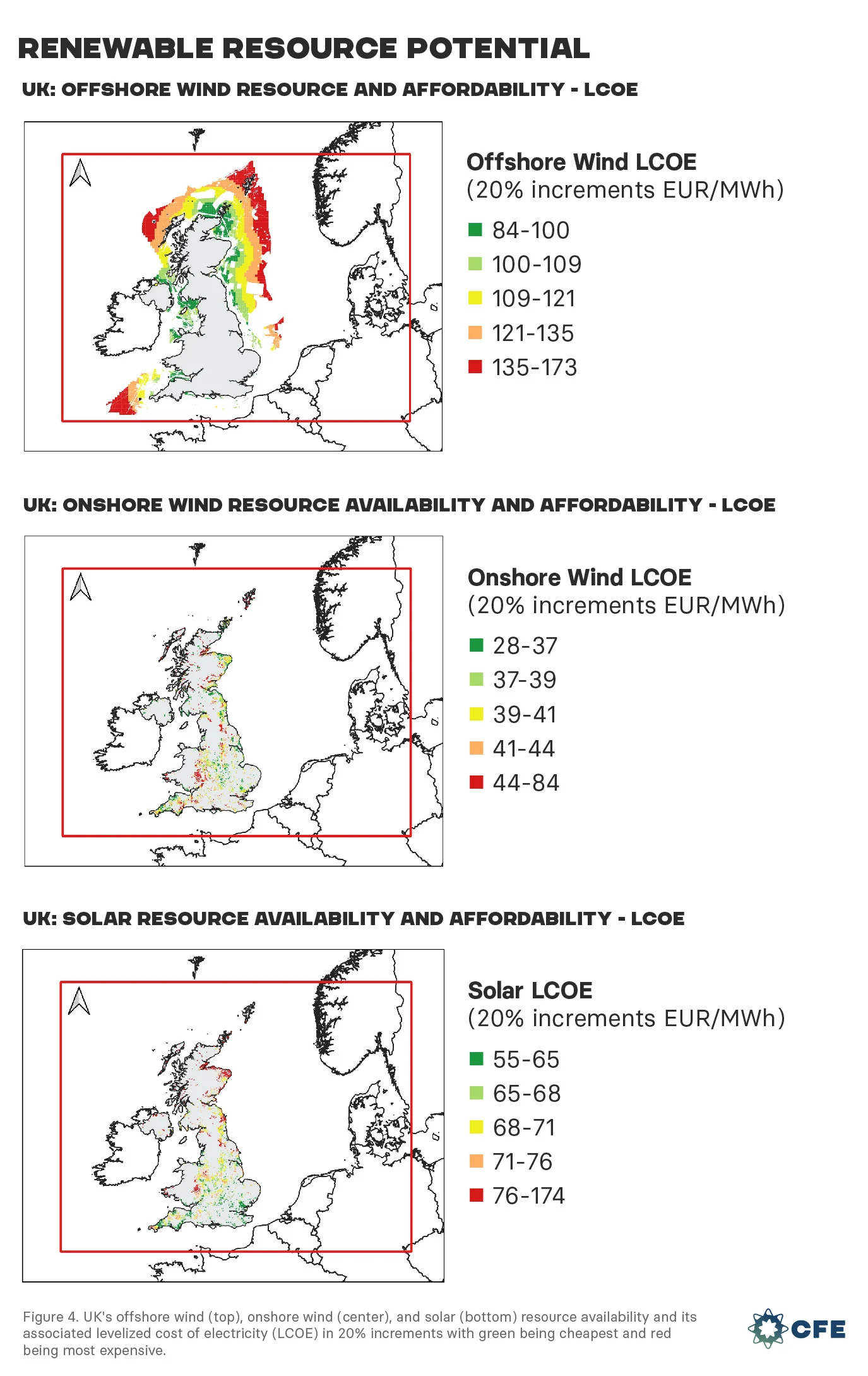

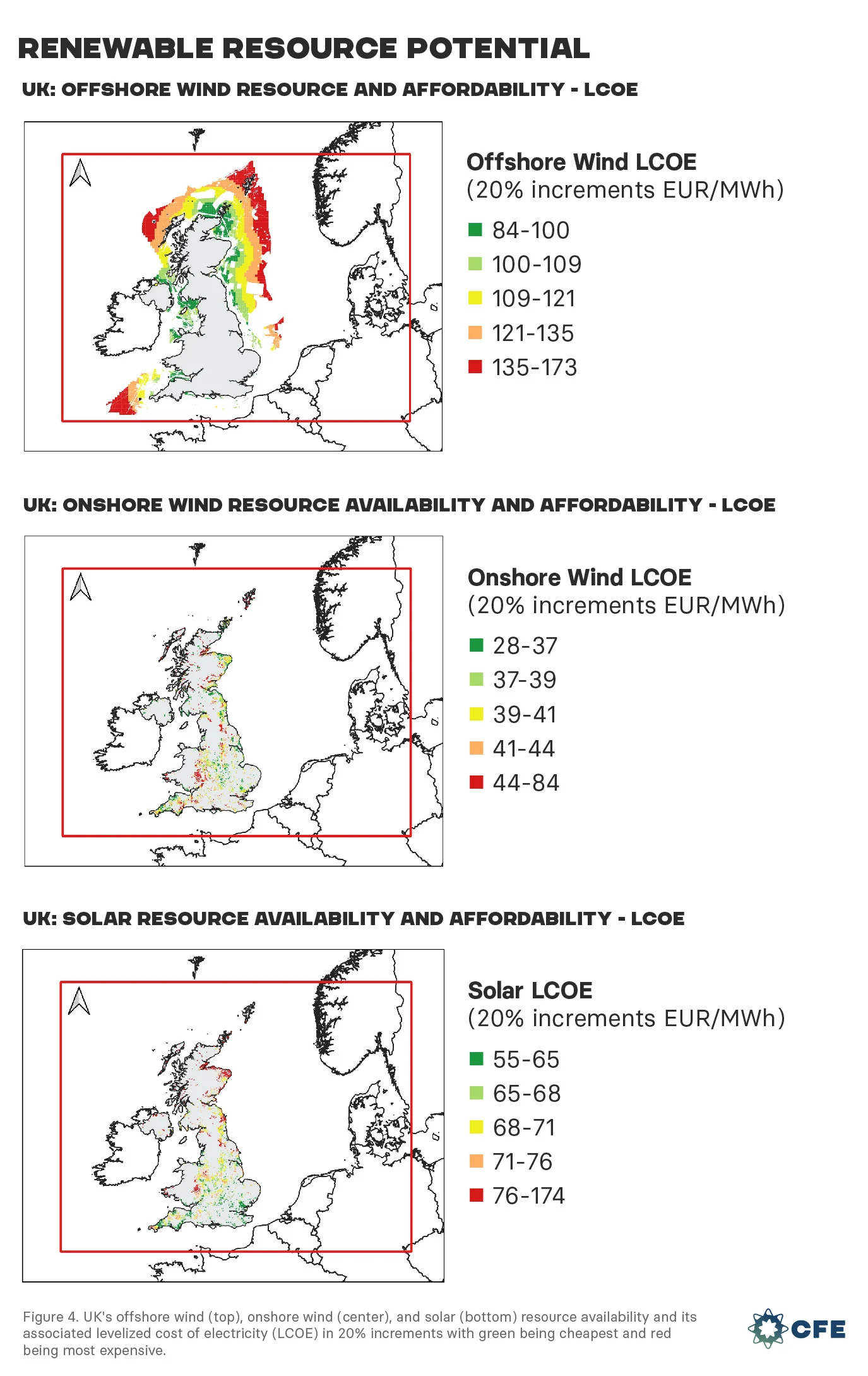

As part of our energy systems analysis, we conducted a study on the resource potential for offshore wind, onshore wind, and solar (Figure 4). The maps below show where these resources can be deployed and what the resource quality (cost) will be depending on each location. The potential for offshore wind is outstanding – The UK is #2 behind Norway (1100+ GW potential). In the UK, there is over 1000 GW of offshore wind capacity potential, 40% of which can cost less than 109 euros (£95) per megawatt hour, on average cheaper than Norway with 128 euros (£112) per megawatt hour (in today’s prices). The next best countries are Ireland with 756 GW, followed by Iceland with 661 GW, and France with 251 GW offshore wind potential. For the UK, solar and onshore wind are cheaper but don’t have anywhere near the resource availability and quality that offshore can provide.

Even with leveraging as much offshore wind potential as possible, the UK will still need other clean energy sources to meet short- and long-term goals. Every technology has different strengths, and a diversified portfolio can maximise them all to increase affordability and reliability. For example, onshore windfarms and solar panels, which, on the one hand face local consent challenges, but are, on the other hand easier to construct and connect quickly compared to nuclear reactors or offshore windfarms. However, nuclear energy and offshore wind have the potential to provide significantly more energy to meet growing demand.

In the short run, the most economic option would be to maintain current clean power capacities and deploy around 22 GWs of onshore wind and 35 GW of solar (in the top 20% of resource quality areas) by 2030. As onshore and solar resource and commercially viable availability dwindles, construction of offshore windfarms and nuclear reactors will become even more important – construction which will require serious investment and planning over the next decade.

The UK will need to balance this influx of intermittent renewable energy with firm, dispatchable resources like nuclear energy, along with short- and long-term duration storage, including an additional 5 GW of electricity storage by 2030. In the long run, grid reliability can be maintained with a combination of the growing baseload-providing nuclear fleet, short-term storage, existing pumped hydroelectric storage, and infrequently used gas peakers (only 11 TWh out of 900 TWh by 2050, which could run on low-carbon fuels instead of natural gas). A breakthrough in long-duration storage would reduce but not negate the need for firm, dispatchable resources. For a look at the hourly operations of the UK grid, please check out our interactive modeling results.

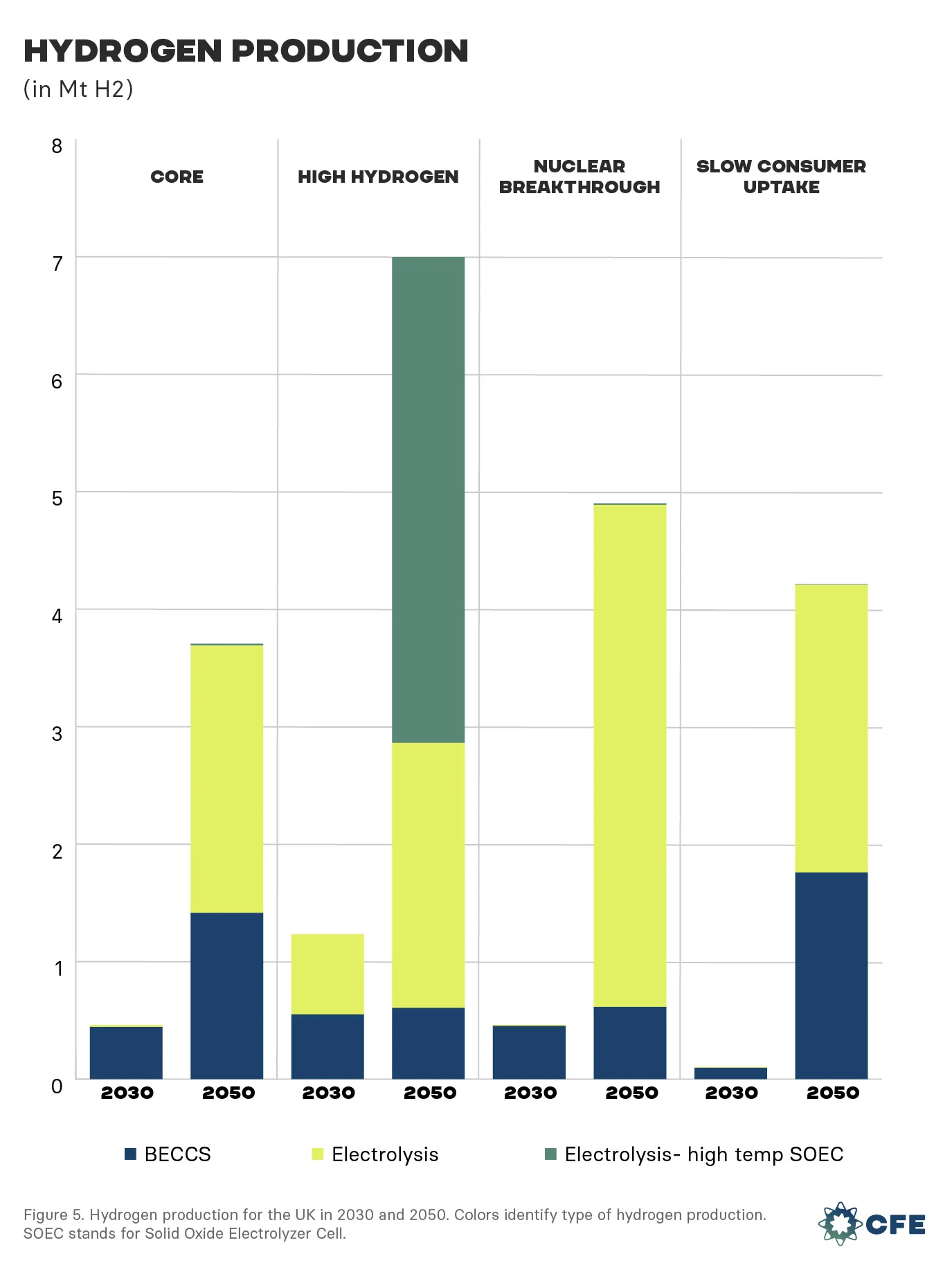

During times of high renewable output, electricity can also be diverted from the grid to use for hydrogen production (Figure 5). This is not just a form of storage – clean hydrogen could then be used to replace refined fuels in parts of the economy that cannot be electrified, such as parts of the transport and heavy industry sectors. Thanks to its incredible offshore wind resources and potential to expand nuclear energy, the UK could become a clean hydrogen production hub, both for domestic use and for export to Europe. The UK is already moving up on this approach by strategically building the Hydrogen Backbone Link to supply up to 10% of Europe’s hydrogen demand by the mid-2030s.19

Navigating Choices for Net-Zero

While the ‘Core Pathway’ is the most feasible and cost-effective, real-world constraints and decisions could push the UK in a different direction. In this section, we explore what alternative pathways to net-zero may look like due to choices made that lead reality astray from the ‘Core Pathway.’ The three other pathways discussed here are ‘High Hydrogen,’ ‘Slow Consumer Uptake’ and ‘Nuclear Breakthrough’. From these pathways, we learn the importance of electrification, critical role of consumer confidence and adoption of clean technologies, and the opportunity of emerging nuclear energy technologies with lower costs and new applications.

The Key is Electrification

Electrification is a well-known essential strategy to achieve net-zero and a major part of all modelled pathways. In our ‘Core Pathway’ the building heating sector is over 80% electrified and the transportation sector (aviation excluded) is over 57% electrified. However, there are other clean energy sources that could substitute electricity, notably zero or low carbon hydrogen. Our ‘High Hydrogen Pathway’ explores if policymakers choose to pursue more clean hydrogen for end-uses like vehicles and industrial processes rather than electrification. While technically doable, this pathway is significantly more expensive (£57 billion more for power and £64 billion more hydrogen production) and difficult to achieve, thus highlighting how important electrification is in comparison to other strategies.

High Hydrogen Pathway: This pathway assumes the UK focuses more on hydrogen for end-uses like vehicles and industrial processes rather than electrification, increasing the demand for zero-carbon fuels to replace liquid fossil fuels. This is less energy efficient.

In the ‘High Hydrogen Pathway,’ hydrogen becomes 50% of final transportation (aviation excluded) energy demand, with only 30% of the transportation sector (aviation excluded) electrified. Overall energy demand for the transportation sector (aviation excluded) is also 20% higher, as hydrogen and other low-carbon fuels are less efficient than electrification. This results in 3.3 times total hydrogen demand for the transportation sector alone. For the entire economy, the UK would need 17.5 million metric tons (Mt) of hydrogen – the majority of which would need to be imported (compared to 6 million metric tons in the ‘Core Pathway’). Assuming 7 Mt of hydrogen is produced domestically, the UK would still need to install the same scale of renewable electric capacity as in the ‘Core Pathway’ (see Figure 1).

It is notable that even in this “High Hydrogen Pathway’, our model does not choose hydrogen over electrification for heating. Our results support that hydrogen is not suitable for heating20 due to its low energy-efficiency and high price, which could lead to higher consumer cost21.

In this scenario, hydrogen supply could be a critical pinch point. Rather than becoming a hydrogen exporter, the UK could rely heavily on imports. There may be feasibility challenges to importing that quantity of low-carbon hydrogen from other European nations, requiring more domestic production and a larger energy sector, specifically nuclear and offshore power. The feasibility risks of a high hydrogen economy emphasises the need to prioritise electrification. This aligns with the general trend of the transportation industry.

Consumers Have a Critical Role

Despite goals to electrify the economy, such as the UK’s goal to install 600,000 heat pumps per year by 2028, if consumers are slow to adopt new clean technologies and electrify their industries, businesses, and households, then reaching net-zero will require a shift in technology use for more carbon capture, utilisation, and storage (CCUS), direct air capture (DAC), and imported zero-carbon fuels. All of which add costs and risk to the UK’s ability to achieve net-zero. The 20-year delay in electrification in the ‘Slow Consumer Uptake Pathway’ leaves no time to catch up with electrification alone by 2050 or establish a substitute hydrogen economy. This pathway is an important reminder that consumer confidence and uptake are essential for the success of electrification efforts.

Slow Consumer Uptake Pathway: This pathway considers a 20-year delay in electrification efforts due to slow consumer adoption, highlighting the impacts on electricity, carbon capture utilization and storage (CCUS), including direct air capture, and alternative fuel demand. This assumes large advances in energy technology.

The delay in electrification in our ‘Slow Consumer Uptake Pathway’ leads to a 13% increased demand for final energy in 2050, being supplied by 50% more fossil fuels than in the non-delayed case. The associated carbon emissions must be counterbalanced (immediately to have a chance to meet Paris Agreement) with investment and deployment into CCUS including carbon capture at the site of production and 25 Mt per year of direct air capture (DAC). The UK would need to sequester 49 Mt of CO2, two times the amount in the ‘Core Pathway.’

In addition to this expansion of carbon capture and direct air capture technologies, this pathway relies on significant imports of zero-carbon fuels – up to 8.3 Mt per year by 2050. The technology innovation, import feasibility challenges, and vast infrastructure construction required between 2040 and 2050 for this pathway are significant hurdles. If the UK is unable to accomplish anyone of one these high-risk strategies, it will be unable to achieve net-zero. It is therefore essential that policymakers implement solutions that increase consumer access and confidence in electric options.

The Importance of Nuclear

Nuclear power emerges as a crucial component for meeting growing energy demand and maintaining grid resilience. High temperature operations from nuclear power plants may also be used for district heating, industrial processes, and hydrogen production when intermittent power systems operate.

Thus, nuclear capacity, set to drop until 2030 (to 5 GW), needs decisive preparation for robust deployment post-2035, envisioning the creation of the largest nuclear fleet in Europe with over 60 GW by 2050, nearly 30 GW by 2035. This strategic nuclear deployment becomes crucial to meeting and even exceeding the UK’s COP28 pledge to triple nuclear capacity by 2050 and to supporting intermittent energy sources.22

Given the pledge and increased attention for nuclear power at COP28, more R&D funding is expected, advancing nuclear technology, potentially leading to a cost-breakthrough for advanced nuclear reactors such as small modular reactors (SMRs).

Nuclear Breakthrough Pathway: This pathway considers effects on the energy system infrastructure with a breakthrough in nuclear technology costs in the mid-2030s, specifically for small modular reactors. This is a paradigm shift for nuclear power.

Our ‘Nuclear Breakthrough Pathway’ analysis shows the impact of nuclear coming down in cost with deployment at scale and innovation, as well as new advanced and small modular reactors having additional applications. The pathway predicts a nuclear capacity of 100 GW for the UK by 2050. This would reduce the need for offshore wind from 80 to 39 GWs by 2050 (demand for onshore wind and solar remains similar, Figure 1). Given nuclear power’s versatility and firm power supply, this pathway reduces transmission cost and supports domestic hydrogen production. Nuclear energy innovation could also provide cheap baseload power for industry and DAC. This pathway speaks to the potential rewards of investing in nuclear technology, something the UK nuclear industry and government are clearly aware of with the recently released Civil Nuclear Roapmap.23

Conclusion: The UK's Strategic Role in Europe's Clean Energy Transition

As the UK navigates the intricate path towards a sustainable net-zero energy future, its strategic role in leading Europe's clean energy transition becomes increasingly pivotal. It can leverage its access to clean energy resources and connections to the continent to be a leader in Europe in the pursuit of clean energy.

As the first major economy to legislate a net-zero emission target, the UK can continue to serve as a catalyst for driving ambitious clean energy policies within Europe. The UK’s commitment to offshore wind, nuclear power, and hydrogen aligns with broader European objectives to reduce reliance on fossil fuel, and offers a pathway for collaborative clean energy development, electrification, and innovation. The UK can not only meet its ambitious emission abatement goals, but also spearhead Europe towards a sustainable energy future.

However, while the UK seeks trade opportunities and leadership in clean energy, it must also ensure resilience and self-sufficiency. Striking this equilibrium requires careful consideration of shared goals, infrastructural alignment, and the development of a robust, interconnected energy network that benefits both the UK and its European counterparts.